Sales Down Seasonally but Fundamentals are Healthy for 2025

Sales at new home projects slowed in Q4, driven primarily by seasonal trends along with some price fatigue among buyers. The hope of lower mortgage rates failed to materialize, preventing any improvement in affordability and keeping some buyers on the sidelines. However, new home demand remains relatively strong, supported by limited new and resale home supply and a healthy job market. Although price appreciation will likely be muted due to affordability challenges, we expect strong new home sales in 2025.

New home sales in Southern CA averaged 2.5/project/mo in Q4 which was slightly below 2023 (2.7) and slightly above the 2016 – 2019 pre-COVID average (2.3/mo/project) for the same quarter. Sales were strongest in Orange County and San Diego County, both averaging 2.7/project/mo in the quarter. It is important to note that Q4 is typically the slowest quarter of the year due in part to the holidays and the onset of colder weather

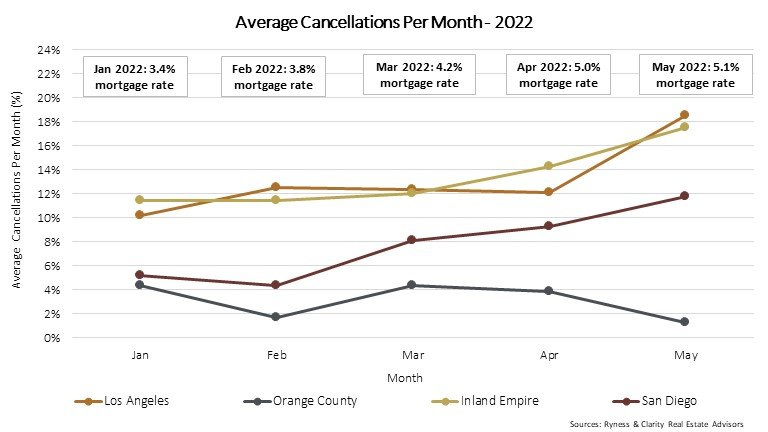

Corresponding with the uptick in mortgage rates, cancellations rose to an average of 17% in November, falling back down to 13% in December. The average for all of Q4 was 15%, up from 12% in Q3. A cancellation rate in the 10 – 15% range is considered typical. The 2016 – 2019 average for Q4 was 18%. San Diego County had by far the lowest cancellation rate in Q4, averaging just 11%, and the Inland Empire and Los Angeles County recorded the highest average rates (18%).

2025 FORECAST

New home projects continue to benefit from mortgage rate buydowns not available in the resale market, allowing buyers to access sub-6% fixed rates. Although Incentives rose in Q4 and will likely be sticky in the near term, overall prices should remain steady. There were just 455 active new home projects in the SoCA region as of Q4, which is 47% below the historical average over the last 30 years and well below the nearly 600 projects in 2017 – 2019. The lack of new home supply in the region, while contributing to poor affordability, will support strong new home sales in 2025.

Clarity Real Estate Advisors provides real estate decision-makers with research-based insights into market dynamics and product trends.